College loan consolidation relieves the students from the tension of repayment of their loans by consolidating them into a single installment and that too at a lower rate of interest. So, it also helps them to concentrate on their studies.

Why college loan consolidation?

Today's career conscious students can actually get great help to ease off their burdens of repayment of large amount of their student loans. They can conveniently pay attention on their selected career instead of wasting their sleep over paying the various installments of monthly student loans. College loan consolidation ensures them a peace of mind even when they are in huge debt.

When a student applies for different loans from various financial institutions, there are numerous interest rates and long term payment system that comes along with such student loans. The main aim behind a consolidation student's loan is to combine the various student loans into a single convenient payment loan system. With these student loan consolidation schemes, the students only need to make a single monthly loan payment instead of the burden of several loan fees for each month. Having the features of less credit checks and lower rates of interest make these consolidation student loans all the more demanding and advantageous.

Relieving the unnecessary tension

College loan consolidation contributes in helping students to focus more on their education and development rather than the debt that needs to be repaid. With a single loan and lower cost of monthly payments, students can enjoy their tension free sleeps. After making a thorough research on the available options in student's loan consolidation, one can find the best and most beneficial consolidation students loan service provider.

Some of the exceptional benefits that are provided while you choose to consolidate student's loan include:·

* Payment of the fixed rate of interest- With some of the federal student's consolidation loans, there may be chances that you would be required to pay a fixed rate for the entire life of the student loan. It is a wise idea to do some research and see the most appropriate rate of interest and the total loan term that you are eligible for.

* Lower amount of monthly payments- Depending upon the amount of the student's loan and the willingness of the lender, students may be able to get the monthly payments lowered up to fifty percent or so.

* Extending the total payment time span- With the help of federal consolidation student's loans, you can avail the facility of extending the repayment period up to a maximum of 30 years or so.

* Having easy and convenient loan payments- By taking the option of consolidating student's loan, the students need to have only a single loan payment for each month and writing a single check. This is highly advantageous in case you are writing various checks each month to several lenders as it can be really confusing as to what amount needs to be paid to which lender?

Availing the online options

Internet has made it easy to approach the lenders who help in a quick student loan consolidation. The World Wide Web contributes tremendously in making convenient the research and finding excellent deals for consolidate student loans with a few mouse clicks. You can get latest quotes and compare different interest rates and quotes of several loan providers and that too without wasting your efforts as you need not waste any money and time in visiting each and every consolidation loan service provider.

http://www.articlesbase.com/

Posted by

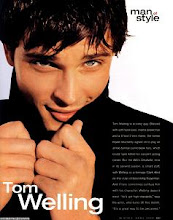

clark kent

at

11:02 AM

![]()

Subscribe to:

Post Comments (Atom)

1 comments:

DO YOU NEED FINANCIAL HELP? 5000$ to 100,000,000.00$

No credit check

Repaid over 1 Year

Approval in 15-30 minutes

Open 7 days a week from 24/7

Service available nationwide

E-MAIL - burgeesjason2@gmail.com

Post a Comment